SECTION 6 • APPENDIX B

HOW TO APPLY FOR MEDICAL ASSISTANCE AND CHIP

Step-by-Step Application Guide

School nurses and other school personnel can directly assist families in applying for Medical Assistance and CHIP. This section provides detailed step-by-step directions on how to complete each question in the online COMPASS application.

The COMPASS application will ask only the questions relevant to the household applying. It will make sure that all the required fields are completed.

Demographic Information

Name, address, contact phone number, and birth date for the head of household. A Social Security number for this person is helpful but not required if that person is not applying for benefits.

If the family gets their mail at a P.O. Box, give the P.O. Box address AND the street address.

What about guardians?

If a child does not live with his/her parents, whoever the child lives with and is exercising care and control of the child is the child’s guardian, and the guardian should be listed in the household section of the application. A child’s guardian might be a grandparent, aunt, uncle, or older sibling, but it can also be someone who is not related to the child by blood.

Households and the Tax Filing Questions

Medical Assistance and CHIP will use tax rules to decide who counts in the household and whose income will count. Each member of the household will be evaluated separately, using the relationship and tax rules.

Many families may not need to file taxes. The application will ask if the family plans to file a federal tax return. It is okay to say no. The eligibility system will use non-filer rules in these cases.

It is important to answer the questions about being claimed as a dependent. Sometimes children are claimed as a dependent by someone who does not live in the household.

If the families files a federal tax return or plans to file one for the current year:

List the tax filer and the spouse and all dependents on the tax form, even if they do not reside at the same address. The application will give you the option to say a dependent lives elsewhere.

There are three exceptions to using the tax household rules:

- A child living with adults who are not their parent.

- A child living with one parent but claimed by a parent who does not live with them.

- A child living with both parents but the parents are not married to each other

In these exceptions, the non-filer rules are used. (See next)

If the family does not file taxes (non-filer rules):

For a child under 19

List the child, any biological, adoptive, or stepparents who live with child, any siblings (biological, adoptive, half, or step) under 19 who live with the child.

Also list the child’s spouse or children who live with the child. For instance, for a teen parent, list the teen’s children.

For an adult over 19:

List the head of household, the spouse of the head of household who lives with the head of household, any children (biological, adopted, or stepchildren) who live in the household.

Important Note

Under the non-filer rules, a grandparent, caregiver, or other adult guardian’s income will not be counted in deciding eligibility.

Add Another Person

List everyone who resides in one household. If the family files federal taxes, list everyone who is claimed in that household, even if they live at another address.

Check the box next to all the names of the people who are applying. Eligibility will only be reviewed for the people applying. Immigration status and Social Security numbers will only be needed for people who are applying.

The application will ask for a driver’s license number or non-driver’s ID number. It is helpful to provide. If not provided, the individual will need to show proof of identity if this is the first time they are applying for a state benefit.

Answer the questions for each person on the household.

Immigration status can include permanent and temporary status for children and pregnant women. Immigration status and Social Security numbers will only be needed for the individuals who are applying.

Immigration Status and Eligibility

In Pennsylvania, all immigrant children under 21 and pregnant women with immigration documents are eligible for Medicaid and CHIP. This is called being “lawfully present.”

In general, children and pregnant women who have an immigration document from United States Citizenship and Immigration Services (USCIS) or a foreign passport and current visa are eligible for Medicaid and CHIP. Children and pregnant women with Deferred Action for Childhood Arrivals (DACA) status or tourist visas cannot receive Medical Assistance or CHIP.

Listed next are the immigration terms that qualify as lawful presence. Most of the families will be either lawful permanent residents, known as green card holders, or individuals with nonimmigrant status. Call Children First at 215-563-5858 x17 if you have any questions about immigration status.

What immigration status has “lawful presence?”

Most common:

- Lawful Permanent Resident (LPR/green card holder)

- Refugee

- Asylee

- Individual with Nonimmigrant Status (includes worker visas; student visas; U visas; citizens of Micronesia, the Marshall Islands, and Palau; and many others)

Less common:

- Cuban/Haitian Entrant

- Paroled into the U.S. for at least one year

- Conditional Entrant

- Granted Withholding of Deportation or Withholding of Removal

- Battered Spouse, Child, and Parent

- Trafficking Survivor and his/her Spouse, Child, Sibling, or Parent Others

- Member of a federally recognized Indian tribe or American Indian born in Canada

- Granted relief under the Convention Against Torture (CAT)

- Temporary Protected Status (TPS)

- Deferred Enforced Departure (DED)

- Deferred Action (except DACA)

- Paroled into the U.S. for less than one year

- Compact of Free Association (COFA)

- Administrative order staying removal issued by the Department of Homeland Security

- Lawful Temporary Resident

- Family Unity

In addition, people who have applied for certain immigration status are considered lawfully present:

- Lawful Permanent Resident (with an approved visa petition)

- Asylum

- Special Immigrant Juvenile Status

- Victim of Trafficking Visa (T visa)

- Withholding of deportation or withholding of removal, under the immigration laws or under the Convention Against Torture (CAT)

And people who have applied for certain immigration status AND have Employment Authorization are considered lawfully present:

Applicant for Temporary Protected Status

- Registry Applicants

- Order of Supervision

- Applicant for Cancellation of Removal or Suspension of Deportation

- Applicant for Legalization under IRCA

- Applicant for LPR under the LIFE Act

What documents prove immigration status?

Document

Permanent Resident Card (I-551)

What to list on the Application

Alien registration number

Card number

Temporary I-551 stamp (on passport or I-94, I-94A)

Alien registration number

Machine Readable Immigrant Vis

(with temporary I551 language)

Alien registration number

Passport number

Country of issuance

Employment Authorization Card (I-766)

Alien registration number

Card number

Expiration date

Category code

Arrival/Departure Record (I-94/I-94A)

I-94 number

Arrival/Departure Record in foreign passport (I-94)

I-94 number

Passport number

Expiration date

Country of issuance

Foreign passport

Passport number

Expiration date

Country of issuance

Income

This includes income earned from a job or self-employment. It also includes unearned income such as child support, Social Security payments for retirement or disability, pensions, rent paid to the household, and unemployment.

What Counts and Does Not Count as Income for Medical Assistance and CHIP?

This includes income earned from a job or self-employment. It also includes unearned income such as child support, Social Security payments for retirement or disability, pensions, rent paid to the household, and unemployment.

Income that counts:

Wages

Salaries

Bonuses

Commissions

Income from an IRA

Pensions

Unemployment compensation

Employer-funded disability payments

Rental income

Self-employment

Social Security income (the portion that is taxable)

Income that does not count:

Child support

Tax credits or refunds

Supplemental Social Security Income (SSI)

Workers Compensation

Self-funded disability payments

TANF payments

List the monthly gross income before taxes and other deductions are taken out. The form will ask for the employer’s name, hourly rate, the number of hours per week, how often the person gets paid, and when the last paycheck was received.

For unearned income, list the amount, how often it is received, and when it was last paid.

Expenses – Transportation

These are optional questions. Transportation expenses are not deducted from income when applying for a child under 18 or a pregnant woman. If you are applying for an adult or a person with disabilities, you may want to answer these questions.

Families can fill in the information about transportation to and from work, whether it is miles traveled or amount paid for transportation, such as bus or subway or train fare, or carpool expenses. Families can also include car payments for the vehicle used to get to and from work.

Other Health Insurance

Families that qualify for Medical Assistance can have other insurance. Medical Assistance would pay for any expenses and services not covered by the private insurance. (This is called secondary insurance.) Co-payments and deductibles as well as services not covered by private insurance would be paid by Medical Assistance.

In some instances, when it is deemed cost effective, Medical Assistance will pay for employer-based insurance. This happens most often when an employer pays a sizeable portion of the premium for family coverage. This is called the Health Insurance Payment Program (HIPP). Medical Assistance will pay the employee’s share of the premium directly to the employer.

Children enrolled in CHIP cannot have other insurance. If a child’s insurance is ending, families can apply to CHIP and state the end date of the current insurance. They may need to provide proof that insurance will end.

Families who are offered insurance by their employer but do not enroll their children may still apply for CHIP.

If the child has health insurance at the time of the application, complete this section. If the child’s insurance will end, be sure to list the date the insurance will end.

Paid and Unpaid Medical Bills

Medical Assistance may cover unpaid medical bills for treatment obtained three months prior to the month of application. This can be a huge help to some families with medical debts. Paid medical bills can be deducted from income in some situations that are not typical for children and pregnant women.

Medical Assistance allows retroactive coverage 90 days prior to the date of application. Individuals must show they were eligible for Medical Assistance in that 90-day period.

Unpaid medical bills and even paid medical bills incurred during that 90-day retroactive period can be deducted from income, making the family eligible. Unpaid medical bills would then be paid by Medical Assistance.

Families would need to send proof of their income during that 90-day retroactive period and copies of the medical bills that include the amount and the date of services.

Sign and Date the Form

COMPASS allows electronic signatures if a Pennsylvania driver’s license or non-driver photo ID is listed on the application.

If the head of household does not have a state-issued photo ID, the signature page can be printed and signed. The signed page can be uploaded to the COMPASS application, mailed to the CAO, or faxed to the CAO. If the page cannot be printed, the person can ask the County Assistance Office to print the signature page and mail it to the person applying. It can then be signed and returned by uploading, mailing, or faxing. The application is automatically date stamped once it is submitted, even without a signature.

Attach Documentation

Under the Affordable Care Act, Medical Assistance and CHIP eligibility workers should check available information from Social Security, employment databases, tax systems, etc. for proof of what is stated on the application.

Families are required to provide proof if the caseworker cannot find electronic proof. Caseworkers can obtain proof of any Social Security income, income from some large employers, and child support payments.

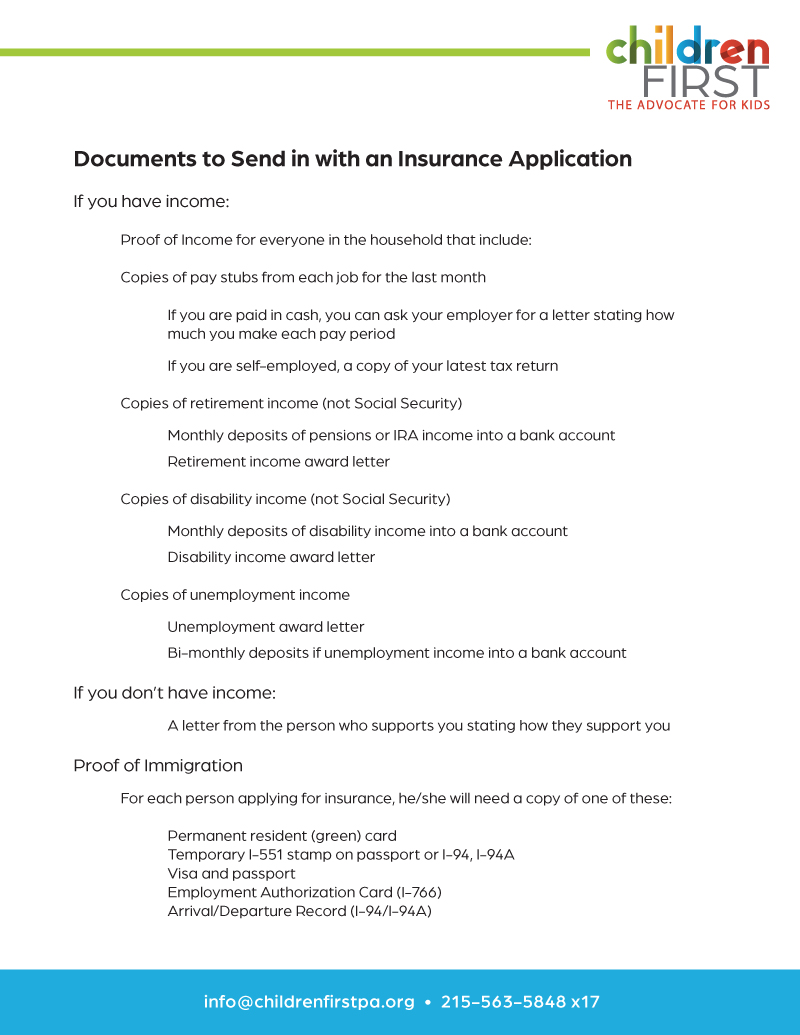

For everyone applying to Medical Assistance or CHIP you need:

Proof of all income for everyone in the household (using one of these for each job)

- Copy of pay stubs (one for each job no more than six weeks old)

- Copy of a tax return if you are self-employed

- Copy of a letter from your employer if you are paid in cash

- Copy of a letter from someone who supports you, if you have no income

- Copy of a “benefit award letter” if you receive child support, unemployment, TANF, social security, SSI, etc.

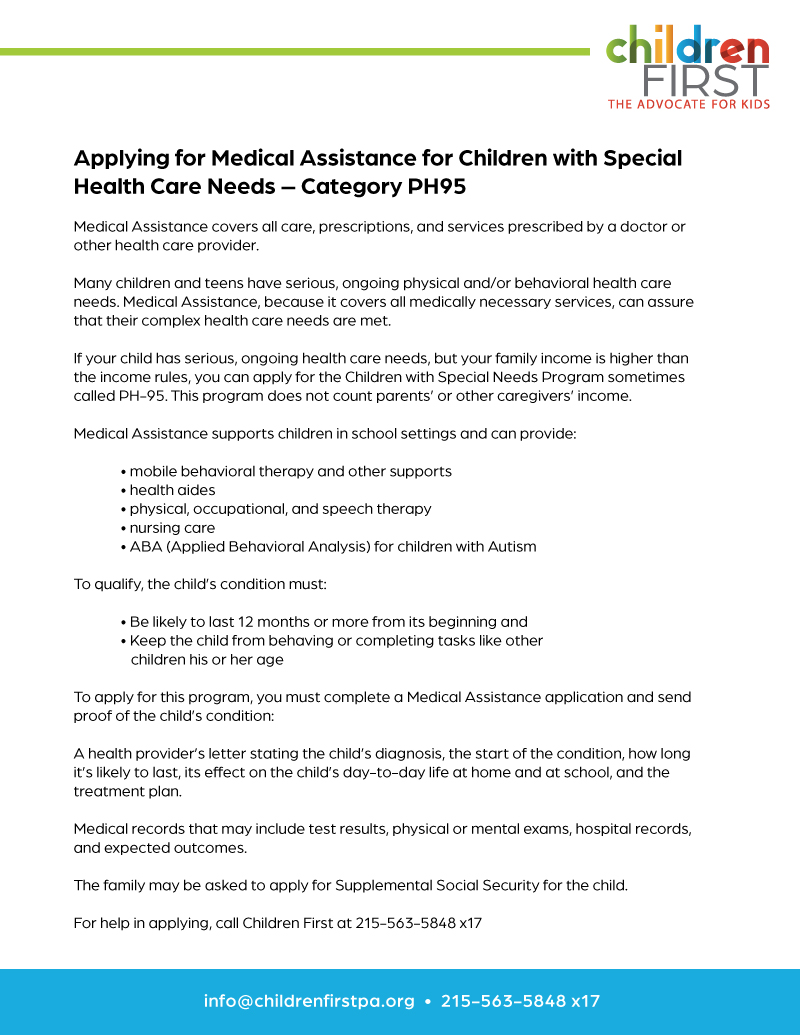

For everyone applying to be covered by Medical Assistance for Children with Special Needs (PH-95) you also need:

Proof of the child’s condition:

- A health provider’s letter stating the child’s diagnosis, the start of the condition, how long it’s likely to last, its effect on the child’s day-to-day life at home and at school, and the treatment plan.

- Medical records that may include test results, physical or mental exams, hospital records, and expected outcomes.

The family may be asked to apply for SSI for the child.

OR

Proof that the child’s condition meets the Social Security Administration’s standards for disability. This can be:

- Documents from the Social Security Administration showing that the caregiver applied for SSI for the child. Applying for SSI is a two-step process: income eligibility and determination of the child’s disability. If the family does not meet income eligibility, they should ask to have the disability evaluated.

- Documents from the Social Security Administration that the child has been denied based on family income but states that the child is disabled based on Social Security criteria.

For everyone applying for Medical Assistance or CHIP who has “lawfully present” immigration status, you need:

Proof of immigration status: such as a

- “Green” card

- Approval letter

- VISA

- Passport

MyCOMPASS

Families can download an app to their smart phone and create a MyCOMPASS account with DHS. MyCOMPASS allows families to upload documents from their phone, renew their coverage, and check their benefit status.

Print or Save a Copy of the Application

It’s helpful to print a copy of the application from COMPASS or save a copy as a download. Print or download the receipt for any documents that are uploaded.

This is very important just in case the family’s application is lost.

Submit Required Documents

At the end of a COMPASS application, there will be a list of documents that need to be submitted. You can submit copies of them by uploading them to the application through the COMPASS website – https://www.compass.state.pa.us – or MyCOMPASS app on your phone. Families can also submit by fax or by mailing or dropping off to the CAO. Put the COMPASS application number on each page of proof.

Families have 30 days to submit their proof.

What to Expect after the Application is Submitted

The County Assistance Office or the CHIP contractor has 30 days to make a decision about eligibility. During that time, an eligibility worker may reach out to the family for more information. The family can submit additional proof, if requested, by uploading the documents through COMPASS, MyCOMPASS, or through the mail, or by dropping it off to the CAO.

If Coverage Has Been Approved

Families should receive a written notice about their coverage within 30 days of submission. If the caseworker or CHIP plan has requested additional information, an answer may come within 45 days.

If coverage has been approved, the letter will include the date coverage becomes effective and, for Medical Assistance, how to choose a physical health plan. See Section 6 – Appendix A

Some families will have to pay a premium to CHIP before coverage can begin. Details on the amount and where to pay are included in the approval letter. [link to more details]

Families have a right to choose a plan in both Medical Assistance and CHIP. If the family has been auto-assigned to a CHIP plan, they can change by calling 800-986-KIDS.

If Coverage Has Been Denied

If the application has been denied, families have a right to appeal. For more information about appeals, see Appendix D, Application Denials and Due Process Rights and Appeals.

In some cases, a family may be denied for Medical Assistance or CHIP, but eligible for the other program. In that instance, the family will receive a denial letter that includes the information that the application has been sent to the other program. The timeline for a decision remains the same, 30 days.

Applying for Emergency Medical Assistance

Emergency Medical Assistance (EMA) is available to children who are immigrants regardless of their immigration status or how long they have been in the United States. It is the only way a child who is an undocumented immigrant can receive Medical Assistance coverage. Importantly, EMA is not a separate category of Medical Assistance, but rather it is a way to get timely critical care regardless of immigration status requirements.

EMA is essentially a temporary enrollment into the Medical Assistance program for a short time to treat a specific medical problem, known as an “Emergency Medical Condition” (EMC). After treatment for the EMC is complete, the enrollment ends.

In order to qualify for EMA, an immigrant must meet all requirements of Medical Assistance eligibility (PA residency, category, and income/resource limits) plus they must have an EMC.

What is an EMC?

An EMC does not necessarily require an “Emergency” in the “Emergency Room” sense of the word. It does require that the immigrant have a serious medical condition meeting the definition of EMC.

Again, an EMC does not require an Emergency Room visit. For example, a tumor that is potentially fatal does not warrant a trip to an Emergency Room, but should certainly be considered a possibility for EMA. An emergency medical condition does not include care and services related to organ transplant procedures.

Labor and delivery is automatically an EMC. In most cases, immigrants need not apply for EMA for labor and delivery, as hospitals report and apply directly for this coverage. Still, it is always a good policy to double check and ensure the hospital actually did apply. Although labor and delivery will be covered as an EMC, pregnancy itself is not an EMC except in the case of a high-risk pregnancy (for example, a pregnant woman who is diabetic may be considered high risk). As such, EMA is not available for prenatal care unless the pregnant woman can show she has a high-risk pregnancy.

An emergency medical condition is a medical condition with acute symptoms of such severity, including severe pain, which without immediate attention, the result may be:

- The patient’s health is in serious jeopardy

- The patient may suffer serious impairment to bodily functions

- The patient may suffer serious dysfunction of any body organ or part

The Doctor’s Letter

The key to an EMA application is a strong letter from a doctor confirming the immigrant’s EMC, along with supporting medical records included with the application.

The doctor’s letter must:

- Identify the specific EMC

- State that the patient meets one or more prongs from the EMC definition, using the exact language of the definition

- State that the need for treatment is “immediate”

- Specify the methods of treatments needed (e.g., doctor’s visits, hospitalization, surgery, etc.) and the duration and frequency of those treatments

- Explain duration of the EMC, using real calendar dates. (Doctors hate to do this because it involves guessing, but it is required. For example: “This EMC started December 11, 2014, and is expected to end March 3, 2015.”

A good rule of thumb is to limit the request to about six months, unless the situation clearly warrants asking for more than six months (e.g., a high-risk pregnancy). Asking for more than six months generally increases the chance of a denial.

- Explain the expected outcome if the immigrant does not receive the requested treatment (e.g., without treatment the patient will suffer terrible health consequences such as paralysis or death, or they will need costly treatments such as a surgery if they are not given EMA.) This increases the chance of an approval.

A template EMC verification letter is available on www.phlp.org. Advocates are encouraged to provide this template letter to the doctor to assist with the application.

Applying for EMA

There is no separate application for EMA; an immigrant can apply for EMA using the standard application form (PA-600HC) or by submitting an application online via COMPASS.

Since applying for EMA entails obtaining and submitting lots of supporting medical documentation to stand up to the medical review process, advocates are encouraged to provide hands-on application assistance wherever possible. Additionally, EMA applicants are not required to provide the following on their EMA application:

➢ Disclosure of immigration status or lack thereof (while certainly you may not provide false information, it is fine to write “EMA only” or “Non-qualified status” if prompted)

➢ Signature of citizenship declaration

➢ Verification of immigration status

➢ Social Security number

Credit: Pennsylvania Health Law Project, Health Care for Immigrants: A Manual for Advocates in Pennsylvania.